Advanced Micro Devices (AMD) shares experienced a sharp decline in pre-market trading on Wednesday, despite surpassing fourth-quarter revenue estimates. The chipmaker issued current-quarter sales guidance that fell short of analysts’ expectations, citing softening demand for its PC chips and central processing units (CPUs).

The Santa Clara, California-based company expects first-quarter sales of approximately $5.4 billion, plus or minus $300 million, which is below the Wall Street consensus of $5.73 billion. While AMD projects a decline in sales for its PC chips business compared to the previous quarter, it anticipates flat data center revenue. The company hopes that growth in graphics processing units (GPUs) sales will help offset the slowing demand for CPUs.

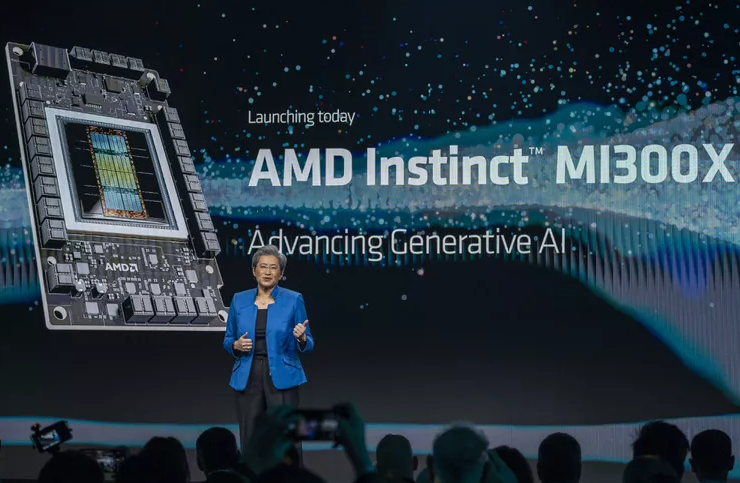

AMD also made an upward revision to its 2024 AI GPU chip sales forecast, expecting $3.5 billion instead of the previously estimated $2 billion. The company highlighted its collaboration with major cloud customers such as Microsoft, Oracle, and Meta on Instinct GPU deployments for both internal AI workloads and external offerings.

In the fourth quarter, AMD reported revenue of $6.17 billion, slightly exceeding the consensus analysts’ estimate of $6.12 billion. The company’s data center and client segments contributed to this growth, with respective year-over-year (YOY) increases of 38% and 62%. The demand for Instinct graphics processors used for AI and recent chip launches drove the growth in these segments.

Despite the recent decline in AMD shares, the stock has been steadily trending higher since briefly dipping below the 200-day moving average in late October. Trading volume has also increased leading up to the company’s earnings announcement. If the stock experiences an earnings-driven retracement, investors should monitor a three-month trendline that may potentially provide support around $160. However, a failure to hold this key chart level could indicate a possible trend reversal.

Also Read – Singapore Saloon: A Tamil Coming-of-Age Movie

Overall, AMD’s fourth-quarter performance exceeded expectations, but the company’s guidance for the current quarter disappointed analysts due to softening demand for its PC chips and CPUs. The growth in graphics processing units sales and the upward revision of AI GPU chip sales forecast provide some optimism for the future. However, the company will need to navigate the challenges posed by the changing market dynamics to maintain its growth trajectory.